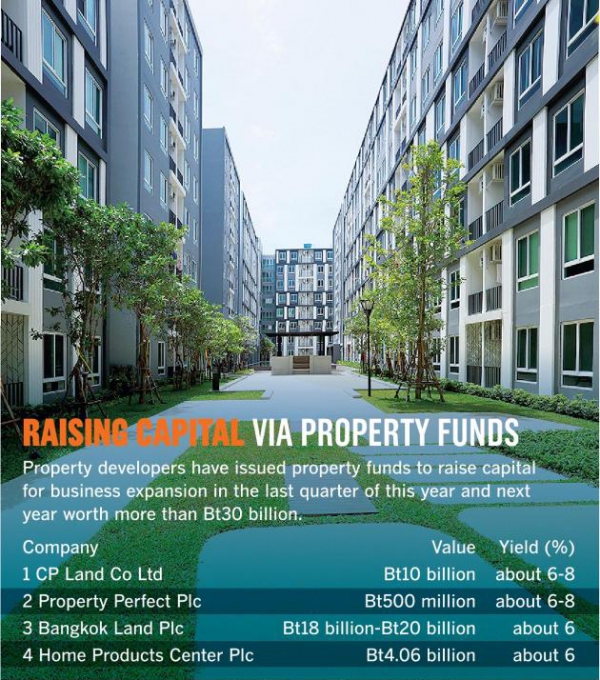

When added to the property funds already issued this year, nearly Bt100 billion worth of such funds will have been issued in total.

Raising funds via the capital market has the advantage of reducing developers' financial costs when compared with borrowing from commercial banks or the issuance of debentures, according to a survey and information from the Securities and Exchange Commission.

This is why some developers have expanded their investment in rental-income businesses such as hotels, office buildings and retail, which are the sources for issuing property funds - to be upgraded to real-estate investment trusts (REITs) next year - with a view to raising capital in the future.

For example, CP Land is issuing the Bt10-billion CP Land Growth Leasehold Property Fund by selling three office buildings - Silom, Ratchada and Phayathai - which currently provide rental income for the company and will generate a return for investors in the fund.

"Issuing the property fund will help us to raise low-cost capital to support our business expansion," said CP Land chief executive officer Sonthorn Urunanonchai.

Listed developer Property Perfect, meanwhile, is issuing a property fund worth Bt500 million, with its Uniloft Salaya dormitory being sold to the Uniloft Property Fund as the income generator.

The company has been planning such a move since 2010, when it started constructing dormitory projects.

Another listed developer, Bangkok Land, plans to issue an REIT worth between Bt18 billion and Bt20 billion next year by using its Impact Exhibition Centre to generate income for the trust.

Home Products Centre will issue a Bt4.06-billion property fund this year, using the long lease on Market Village Hua Hin to generate a return for the fund.

Recurring income

While property funds/REITs are means of raising low-cost capital for developers, some listed property firms are interested in developing projects that will directly provide recurring income for the company in the future.

Sansiri has introduced two new hotel and resort projects, together worth Bt370 million, under the Escape Sansiri Hotel Collection brand in Khao Yai and Hua Hin.

The company is also studying developing the same concept in tourist destinations such as Chiang Mai, Phuket and Pattaya.

Golden Land Property Development plans to develop a mixed-used project worth more than Bt7 billion on a 9-rai (1.44 hectare) plot in Khlong Toei, under a 30-year lease from the Crown Property Bureau.

Sena Development, meanwhile, is developing a hotel and resort as well as retail property in Pattaya and Bangkok, worth nearly Bt3 billion combined.

Ananda Development, which is also interested in expanding into direct rental income, plans to issue an REIT from condominium projects that will be developed to include space for rental purposes.

Meanwhile, a number of other leading property firms have been expanding their businesses for more than five years in order to focus on rental income.

Land and Houses has expanded into retail business, Supalai has invested in the office and hotel segments, and Quality Houses has done so in the office and serviced-apartment segments.

These companies have also raised capital via property funds since the beginning of last year.

Chavinda Hanratanakool, Krung Thai Asset Management senior executive and vice president for property fund and private fund management, said a planned Bt30-

billion property fund would invest in freehold interests in 10 leading hotels around the country.

The fund is pending approval by the Securities and Exchange Commission.

She said individual property funds would continue to be issued in the remaining months of the year, before being upgraded to REITs.

Moreover, infrastructure funds, which fund managers estimate to be worth around Bt100 billion, will be issued in the same period.

The outlook for the Stock Exchange of Thailand in the current quarter is bright, she said, so many corporates plan to raise funds from initial public offerings (IPOs), as well as from property funds.

The SET Index may not be very volatile because the market has already acknowledged the impact from the current US government shutdown and the approaching deadline for raising the US debt ceiling, she added.

Sitthichai Mahaguna, executive vice president of CIMB Thai Bank, said the bank has three or four deals in the pipeline worth a total of Bt10 billion: one IPO and two or three property funds.

CIMB is accelerating closure of the deals in a bid to achieve its target of 50-per-cent fee-income growth this year, he said.

The bank is pursuing investment-banking business for next year, but is still focusing on IPOs and mergers and acquisitions, and will be active in mandating REITs and infrastructure funds, he added.